Your Hcl tech debt images are available in this site. Hcl tech debt are a topic that is being searched for and liked by netizens today. You can Download the Hcl tech debt files here. Download all royalty-free photos and vectors.

If you’re searching for hcl tech debt pictures information related to the hcl tech debt topic, you have visit the ideal site. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

Hcl Tech Debt. HCL Technologiess Long-Term Debt Capital Lease Obligation for the quarter that ended in Mar. Fair Value Median EV EBIDTA Model. A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. Vice-versa an increasing debt is a bad sign.

Hcl Tech Strategizes A Unique Roadmap To Growth From blog.covalue.io

Hcl Tech Strategizes A Unique Roadmap To Growth From blog.covalue.io

Shah said the company is also likely to take on further debt of 200 million and that clearly shows that it is taking a lot of balance sheet risk to drive growth. Start your Free Trial. HCLTECHs debt to equity ratio 63 is considered satisfactory. As you can see below HCL Technologies had US4277m of debt at September 2020 down from US6079m a year prior. The Balance Sheet Page of HCL Technologies Ltd. 2021 was 9489 Mil.

Start your Free Trial.

Presents the key ratios its comparison with the sector peers and 5 years of Balance Sheet. Vice-versa an increasing debt is a bad sign. 2021 was 9489 Mil. A high debt equity ratio is a bad sign for the safety of investment. Keep an eye on HCL Technologies Ltds total debt short and long term leases debentures. HCL Tech Consolidated December 2020 Net Sales at Rs 1930200 crore up 644 Y-o-Y.

Source: yumpu.com

Source: yumpu.com

HCLTECHs debt to equity ratio has increased from 35 to 63 over the past 5 years. However it does have US150b in cash offsetting this leading to net cash of US107b. HCL Technologies Ltd. HCL Technologies Ltd Indias fifth-largest software services firm cut its net debt to 130 million from the end-June level of 221 million Chief Financial Officer Anil Chanana told a. HCL Technologiess Short-Term Debt Capital Lease Obligation for the quarter that ended in Mar.

Source: businesstoday.in

Source: businesstoday.in

HCL Tech Standalone December 2020 Net Sales at Rs 940400 crore up 867 Y-o-Y. - The Key ratio of HCL Technologies Ltd. HCL Tech Financial Ratio profitability ratios company liquidity ratio key financial analysis statutory liquidity ratio on Moneycontrol. HCL Technologies Q4 profit falls 26 QoQ to Rs 2962 crore. Fair Value Median EV EBIDTA Model.

Source: businesstoday.in

Source: businesstoday.in

HCL Technologies Q4 profit falls 26 QoQ to Rs 2962 crore. HCL Techs share price declined more than 4 or by Rs 4650 on Friday to close at Rs 108605 on the BSE. HCLs rapidly-deployed Debtor Risk Profiling solution powered by SAP Analytics Cloud automatically highlights risk profiles allowing users to quickly review which of their customers is becoming an increasing credit risk so you can take appropriate action earlier and thus save money improve cash flows and reduce bad debt write-offs. The Balance Sheet Page of HCL Technologies Ltd. Has a ROE of 2648.

Source: 36guide-ikusei.net

Source: 36guide-ikusei.net

70276 determined based on Median of the 3 historical models. Start your Free Trial. Keep an eye on HCL Technologies Ltds total debt short and long term leases debentures. A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. 2021 was 9489 Mil.

Source: financialexpress.com

Source: financialexpress.com

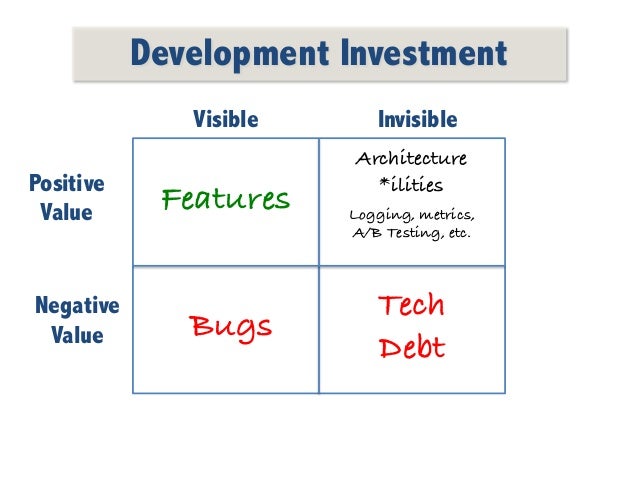

HCL Tech Standalone December 2020 Net Sales at Rs. Company including debt equity ratio turnover ratio etc. Technology debt is a familiar term for CIOs around the world referring to a companys failure to leverage newer technologies and losing out on potential improvements in. Higher is better Debt to equity ratio. HCL Tech Standalone December 2020 Net Sales at Rs 940400 crore up 867 Y-o-Y.

Source: 36guide-ikusei.net

Source: 36guide-ikusei.net

Higher is better Debt to equity ratio. HCL Technologies Q4 profit falls 26 QoQ to Rs 2962 crore. Was incorporated in the year 1991. DEBT EQUITY RATIO 000 chg. Presents the key ratios its comparison with the sector peers and 5 years of Balance Sheet.

Source: bondevalue.com

Source: bondevalue.com

- It is a good metric to check out the capital structure along with its performance. HCL Technologiess Long-Term Debt Capital Lease Obligation for the quarter that ended in Mar. The Market Cap is calculated as Enterprise ValueMarket CapTotal DebtCash and Cash Equivalents. HCL Techs share price declined more than 4 or by Rs 4650 on Friday to close at Rs 108605 on the BSE. HCLTECHs debt to equity ratio 63 is considered satisfactory.

Source: blog.covalue.io

Source: blog.covalue.io

Keep an eye on HCL Technologies Ltds total debt short and long term leases debentures. Company including debt equity ratio turnover ratio etc. Keep an eye on HCL Technologies Ltds total debt short and long term leases debentures. Was incorporated in the year 1991. HCL Techs share price declined more than 4 or by Rs 4650 on Friday to close at Rs 108605 on the BSE.

Source: financialexpress.com

Source: financialexpress.com

As on 17-Jun-2021 the Intrinsic Value of HCLTECH is Rs. Shah said the company is also likely to take on further debt of 200 million and that clearly shows that it is taking a lot of balance sheet risk to drive growth. The Balance Sheet Page of HCL Technologies Ltd. HCLTECHs debt to equity ratio 63 is considered satisfactory. Start your Free Trial.

Source: 36guide-ikusei.net

Source: 36guide-ikusei.net

HCL Technologiess Short-Term Debt Capital Lease Obligation for the quarter that ended in Mar. - It is a good metric to check out the capital structure along with its performance. Keep an eye on HCL Technologies Ltds total debt short and long term leases debentures. Was incorporated in the year 1991. Financial Ratios Analysis of HCL Technologies Ltd.

Company including debt equity ratio turnover ratio etc. Vice-versa an increasing debt is a bad sign. Financial Ratios Analysis of HCL Technologies Ltd. HCLs rapidly-deployed Debtor Risk Profiling solution powered by SAP Analytics Cloud automatically highlights risk profiles allowing users to quickly review which of their customers is becoming an increasing credit risk so you can take appropriate action earlier and thus save money improve cash flows and reduce bad debt write-offs. HCLTECHs debt is well covered by operating cash flow 4869.

Source: financialexpress.com

Source: financialexpress.com

A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. As you can see below HCL Technologies had US4277m of debt at September 2020 down from US6079m a year prior. If the debt is decreasing over a period of time it is a good sign. A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. HCL Technologies Ltd.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hcl tech debt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.