Your Is there a tech bubble 2020 images are available in this site. Is there a tech bubble 2020 are a topic that is being searched for and liked by netizens today. You can Download the Is there a tech bubble 2020 files here. Get all royalty-free vectors.

If you’re looking for is there a tech bubble 2020 images information related to the is there a tech bubble 2020 topic, you have come to the ideal site. Our website always gives you hints for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Is There A Tech Bubble 2020. Money has flowed into technology stocks after the March 2020 market crash. Apple AAPL is near an all-time high. Also following the same pattern is the Feds expansion of its balance sheet prior to the 2001 tech bubble. Emanuel who came into 2020 as one of Wall Streets biggest bulls isnt sure what could prick the bubble He suggests it could be anything from escalating US.

Percent Of Money Losing Ipos As High As 2000 Tech Bubble Peak Deflation Market Bubbles Tech Stocks Chart From pinterest.com

Percent Of Money Losing Ipos As High As 2000 Tech Bubble Peak Deflation Market Bubbles Tech Stocks Chart From pinterest.com

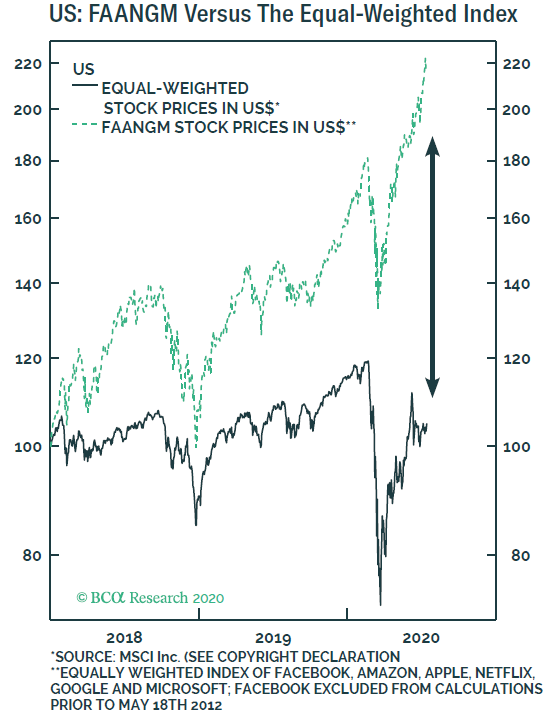

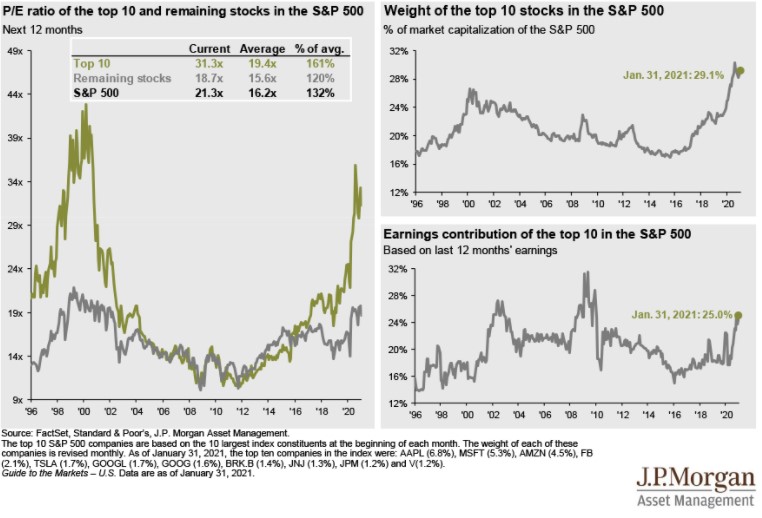

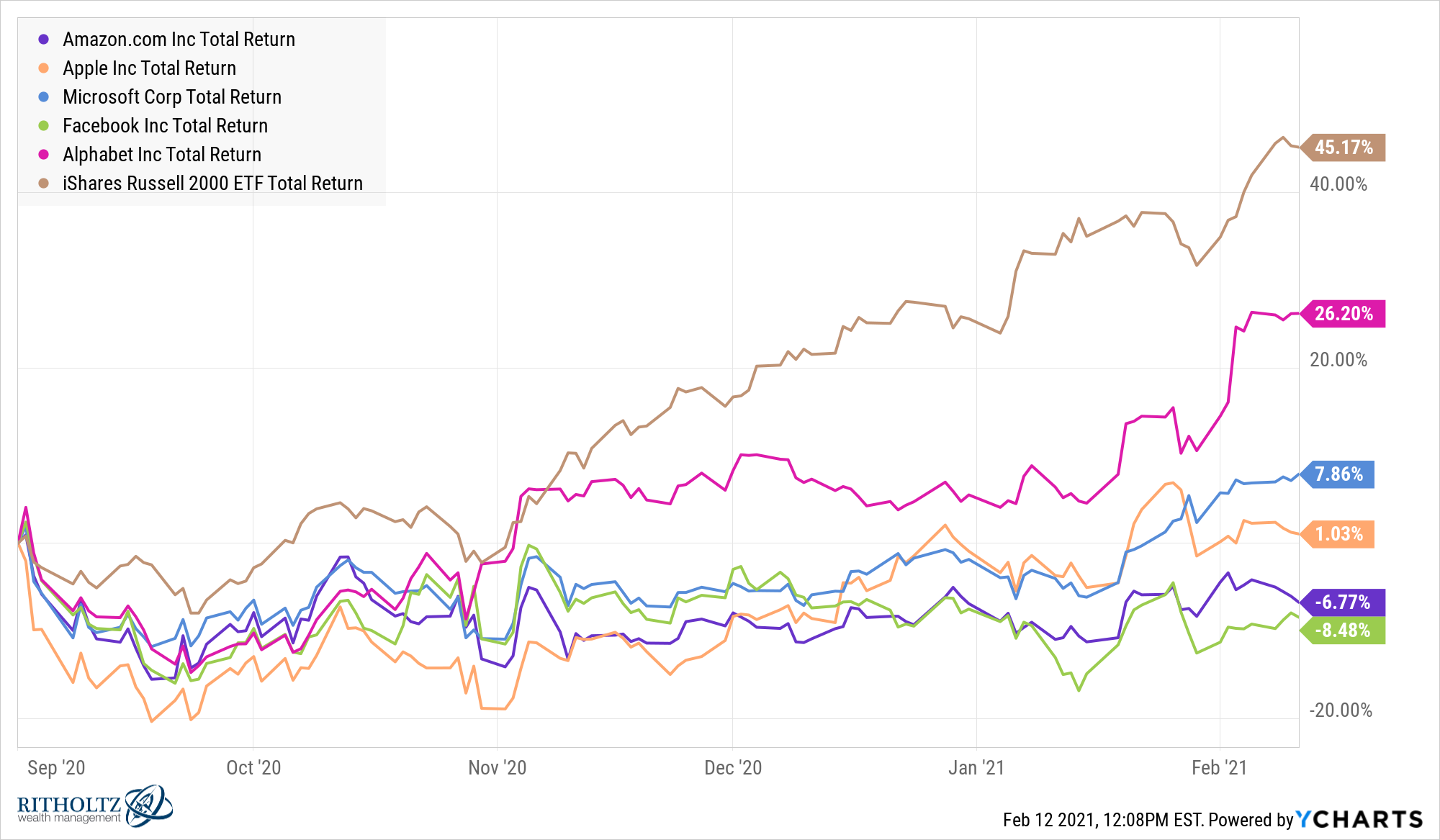

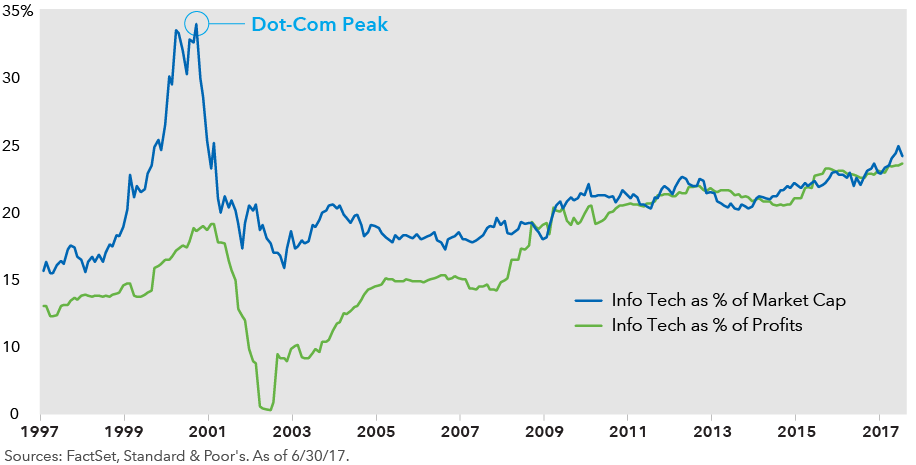

Predicting the outlook for. New York CNN Business There has been a furious rally in tech stocks since the market plunged a week ago. 2020 Stock Bubble is Broader than 2000s Tech Bubble by Gary Gordon Jan 31 2020 During 2000s tech bubble the insanity was primarily contained to the info tech. While the recent tech-driven rally may be of concern to those who invested through the. But not everything is different about technology shares in 2020. Whether it be pre-revenue stocks receiving sky-high valuations in the electric vehicle space or a record rise in SPACs and IPOs there are some parallels between the 2020 and 2000 markets.

When many tech companies went up in smoke.

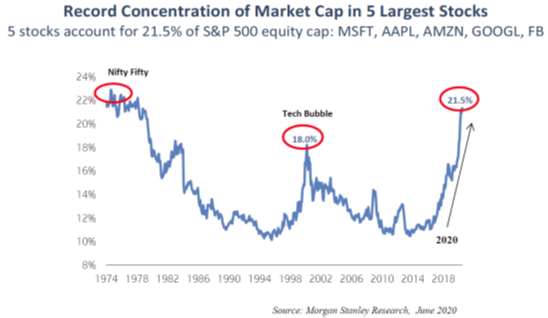

But its not going to take. Apple AAPL is near an all-time high. But not everything is different about technology shares in 2020. In this graph you can see both the market cap concentration and the lack of net income which preceded the bursting of the tech bubble in 2001 and could potentially precede a similar outcome in 2020. Money has flowed into technology stocks after the March 2020 market crash. The post Is There a Tech Bubble That Could Burst in 2020.

Source: fr.pinterest.com

Source: fr.pinterest.com

Tesla and Apple are approaching the. Tensions with China to the. But not everything is different about technology shares in 2020. This is similar to what was seen back in 2000. So are tech giants Adobe.

Source: wescapgroup.com

Source: wescapgroup.com

FactSet also estimates that the SP 500s earnings for 2020 have fallen 22 since the beginning of the year while 2021 earnings have declined 13. Emanuel who came into 2020 as one of Wall Streets biggest bulls isnt sure what could prick the bubble He suggests it could be anything from escalating US. So are tech giants Adobe. Also following the same pattern is the Feds expansion of its balance sheet prior to the 2001 tech bubble. Predicting the outlook for.

Source: awealthofcommonsense.com

Source: awealthofcommonsense.com

Tensions with China to the. Whether it be pre-revenue stocks receiving sky-high valuations in the electric vehicle space or a record rise in SPACs and IPOs there are some parallels between the 2020 and 2000 markets. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the. The post Is There a Tech Bubble That Could Burst in 2020. When many tech companies went up in smoke.

Source: pinterest.com

Source: pinterest.com

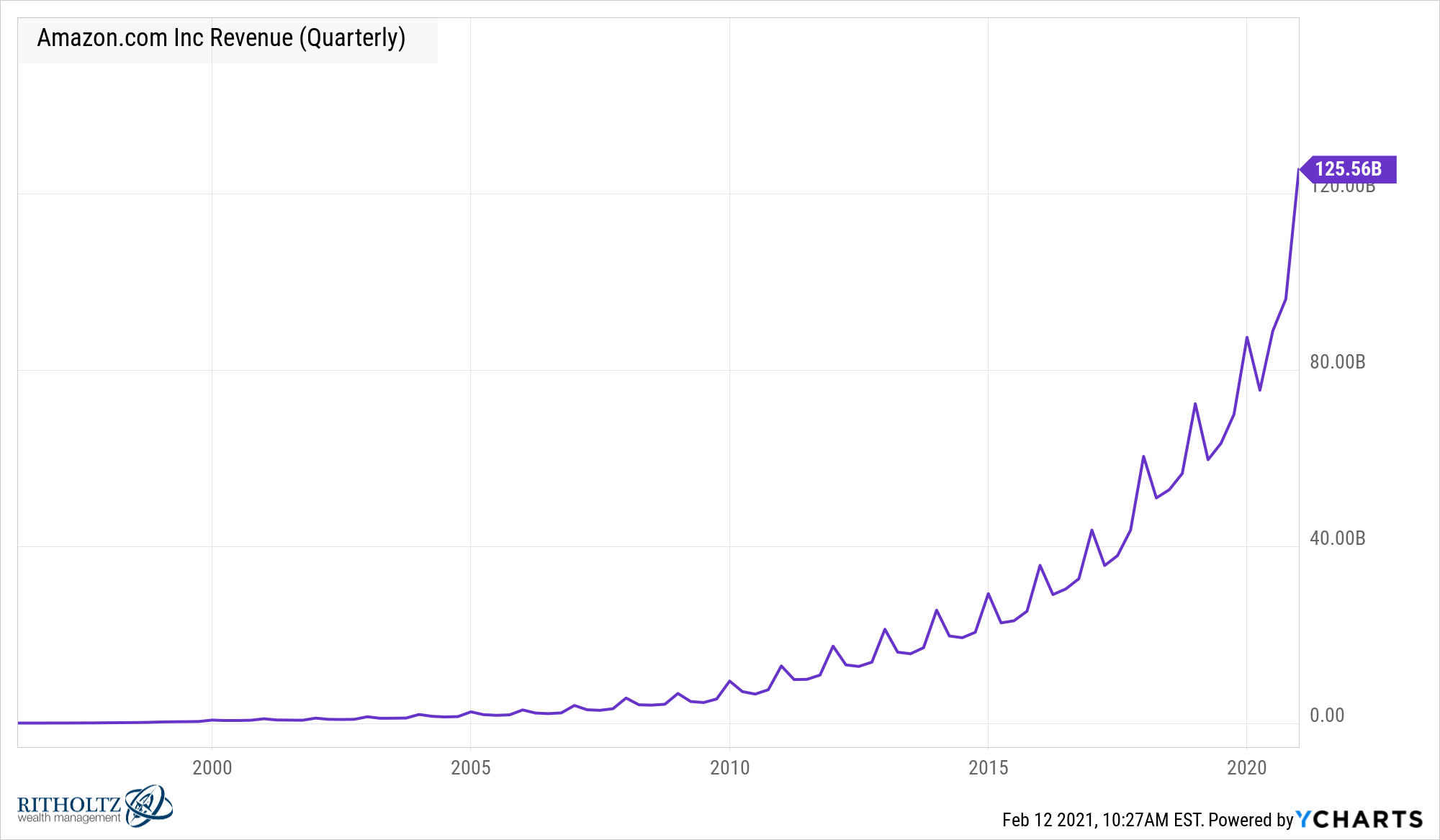

Money has flowed into technology stocks after the March 2020 market crash. But its not going to take. While the recent tech-driven rally may be of concern to those who invested through the. FactSet also estimates that the SP 500s earnings for 2020 have fallen 22 since the beginning of the year while 2021 earnings have declined 13. Market capitalizations are soaring along with the market value of individual shares.

Source: wescapgroup.com

Source: wescapgroup.com

Predicting the outlook for. While the recent tech-driven rally may be of concern to those who invested through the. Market capitalizations are soaring along with the market value of individual shares. Tesla and Apple are approaching the. FactSet also estimates that the SP 500s earnings for 2020 have fallen 22 since the beginning of the year while 2021 earnings have declined 13.

Source: pinterest.com

Source: pinterest.com

The post Is There a Tech Bubble That Could Burst in 2020. But its not going to take. But not everything is different about technology shares in 2020. Is there a tech bubble that could burst in 2020. Also following the same pattern is the Feds expansion of its balance sheet prior to the 2001 tech bubble.

Source: medium.com

Source: medium.com

Money has flowed into technology stocks after the March 2020 market crash. So are tech giants Adobe. But its not going to take. Is there a tech bubble that could burst in 2020. Whether it be pre-revenue stocks receiving sky-high valuations in the electric vehicle space or a record rise in SPACs and IPOs there are some parallels between the 2020 and 2000 markets.

Source: awealthofcommonsense.com

Source: awealthofcommonsense.com

While the recent tech-driven rally may be of concern to those who invested through the. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the. Market capitalizations are soaring along with the market value of individual shares. This is similar to what was seen back in 2000. There could be a course correction he said.

Source: investopedia.com

Source: investopedia.com

Appeared first on The Motley Fool Canada. Market capitalizations are soaring along with the market value of individual shares. With investor money flowing freely tech start-ups spent aggressively to drive growth which led to the bubble bursting when growth slowed and profits never materialized. This is similar to what was seen back in 2000. While the recent tech-driven rally may be of concern to those who invested through the.

Source: awealthofcommonsense.com

Source: awealthofcommonsense.com

When many tech companies went up in smoke. Whether it be pre-revenue stocks receiving sky-high valuations in the electric vehicle space or a record rise in SPACs and IPOs there are some parallels between the 2020 and 2000 markets. 2020 Stock Bubble is Broader than 2000s Tech Bubble by Gary Gordon Jan 31 2020 During 2000s tech bubble the insanity was primarily contained to the info tech. Also following the same pattern is the Feds expansion of its balance sheet prior to the 2001 tech bubble. No Envy for Analysts Cheaper debt and less of it healthy profits and a virus-based boost to business.

Source: pinterest.com

Source: pinterest.com

You can see heading into 2020 the Nasdaq rose sharply. Tesla and Apple are approaching the. You can see heading into 2020 the Nasdaq rose sharply. Emanuel who came into 2020 as one of Wall Streets biggest bulls isnt sure what could prick the bubble He suggests it could be anything from escalating US. Appeared first on The Motley Fool Canada.

Source: capitalgroup.com

Source: capitalgroup.com

There could be a course correction he said. When many tech companies went up in smoke. Tesla and Apple are approaching the. With investor money flowing freely tech start-ups spent aggressively to drive growth which led to the bubble bursting when growth slowed and profits never materialized. Predicting the outlook for.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is there a tech bubble 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.