Your Tech bubble catalyst images are ready in this website. Tech bubble catalyst are a topic that is being searched for and liked by netizens today. You can Download the Tech bubble catalyst files here. Download all free images.

If you’re searching for tech bubble catalyst images information related to the tech bubble catalyst keyword, you have pay a visit to the right blog. Our site always provides you with hints for seeing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

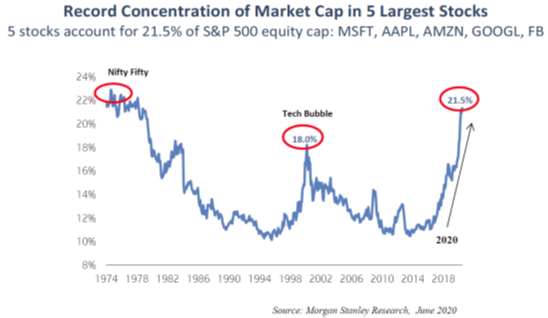

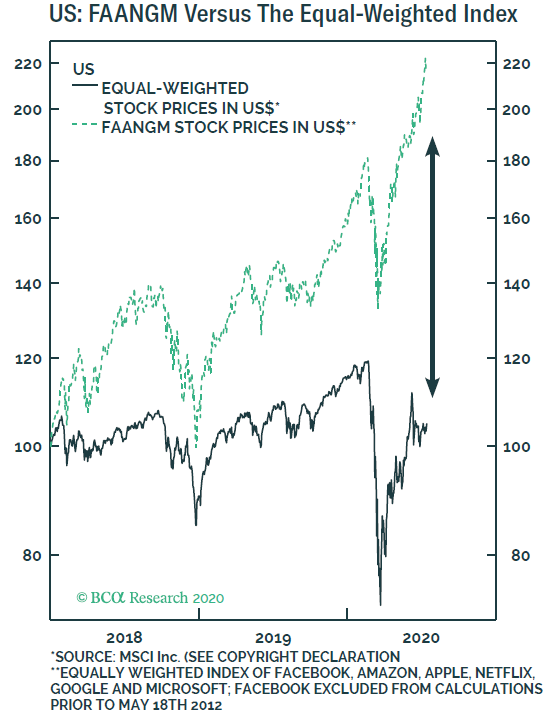

Tech Bubble Catalyst. Technology stock equity valuations fueled by investments in Internet-based companies during the bull market in the late 1990s. You wont find an agreed-upon singular catalyst for the bursting of 2000s tech bubble. The dotcom bubble started growing in the late 90s as access to the internet expanded and computing took on an increasingly important part in peoples daily lives. The catalyst for profit taking could be regulatory strains or excessive.

1 Corry Wang On Twitter 1 Lessons From The Tech Bubble Last Year I Spent My Winter Holiday Reading Hundreds Of Pages Of Eq In 2021 Investing Corry Understanding From pinterest.com

1 Corry Wang On Twitter 1 Lessons From The Tech Bubble Last Year I Spent My Winter Holiday Reading Hundreds Of Pages Of Eq In 2021 Investing Corry Understanding From pinterest.com

In 2001 there was a tech bubble known as the Dot Com Bubble created by excessive speculation in internet-based service companies. What occurred after was the catalyst for the Tech Bubble - stock volatility. As a result the SP 500s technology sector. They soared to new highs when people started investing in these. The aftershock sent NASDAQ tumbling all the way to 3649 before bouncing back slightly to 4223. The tech bubble has inflated dramatically and these signs indicate the party could come to a brutal end soon.

In early 1998 we fought the Tech bubble from 21x equal to the previous record high in 1929 to 35x before a 50 decline.

The peak of the Tech Bubble at least with respect to NASDAQ was on March 10 2020 the SP peaked a little later on March 24th. One signature event came on April 3 when a federal court declared Microsoft a monopoly. It was marked by great uprise in the stock prices of particularly Internet based companies from 19972000 and a sudden plunge in the late 2000 -2002. The number of cases in. The aftershock sent NASDAQ tumbling all the way to 3649 before bouncing back slightly to 4223. As a result the SP 500s technology sector.

Source: pinterest.com

Source: pinterest.com

Fund raising for tech especially information tech is primarily driven by fundamentals and growth catalysts today as opposed to the euphoria that came to drive venture capitalist in 2000. This can start in a different financial market such as futures options commodities currencies or bonds. And there in lies the rub. Technology stock equity valuations fueled by investments in Internet-based companies during the bull market in the late 1990s. It just may take a different catalyst to turn the tech tide this time around.

Source: wescapgroup.com

Source: wescapgroup.com

The dotcom bubble started growing in the late 90s as access to the internet expanded and computing took on an increasingly important part in peoples daily lives. A bubble will only burst IF and WHEN there is a catalyst on the retail-side that triggers a Panic-Mode Run on the stock market. The tech bubble has inflated dramatically and these signs indicate the party could come to a brutal end soon. Fund raising for tech especially information tech is primarily driven by fundamentals and growth catalysts today as opposed to the euphoria that came to drive venture capitalist in 2000. Stock volatility is mainly found in companies that offer little to no dividends.

Source: pinterest.com

Source: pinterest.com

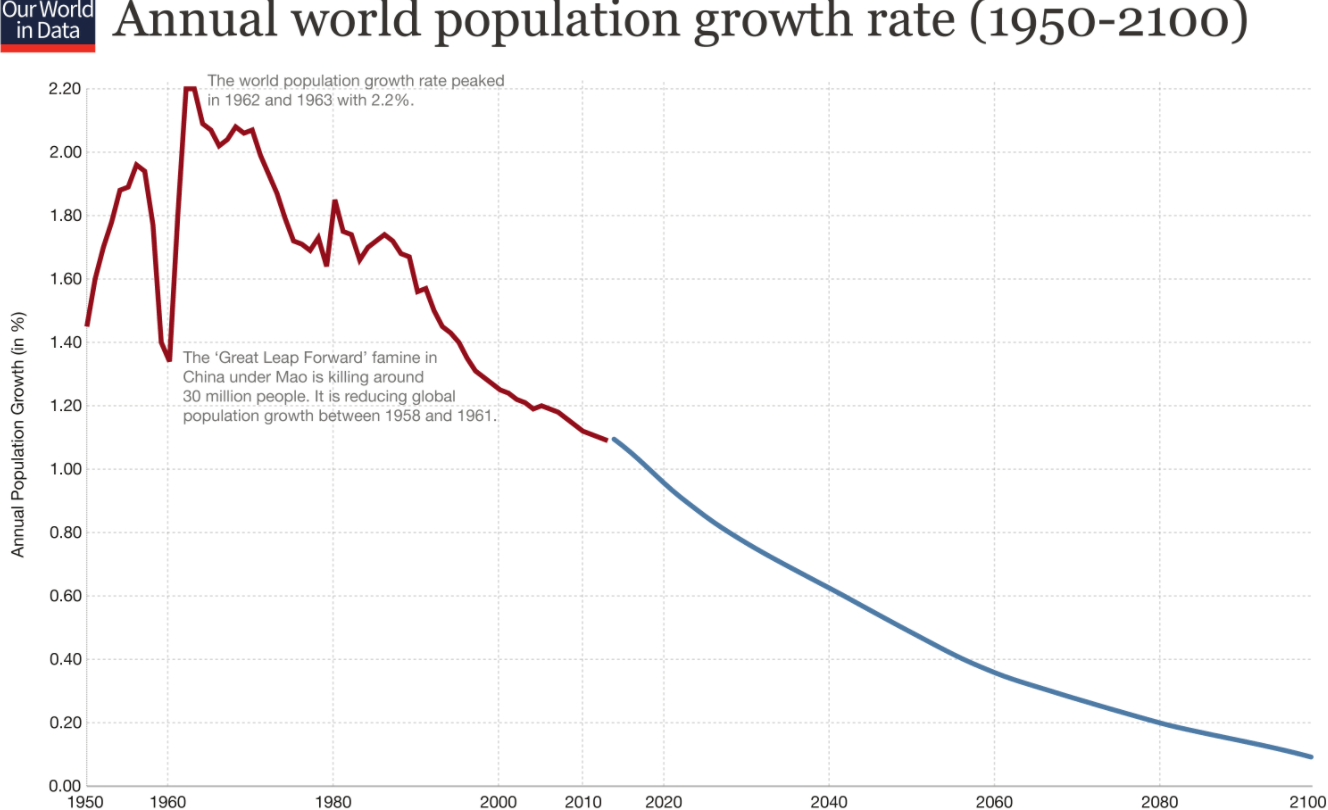

Its hard to argue with the increased user base of technology over the last 15 yearsgrowth has been enormous all around the world. The dotcom bubble started growing in the late 90s as access to the internet expanded and computing took on an increasingly important part in peoples daily lives. These companies were the ones that soared during the 1990s2000s. The dotcom bubble was a rapid rise in US. What occurred after was the catalyst for the Tech Bubble - stock volatility.

Source: seekingalpha.com

Source: seekingalpha.com

It was marked by great uprise in the stock prices of particularly Internet based companies from 19972000 and a sudden plunge in the late 2000 -2002. They soared to new highs when people started investing in these. The internet and technology companies. This is the next indicator on the horizon that will underline that we are in a tech bubble and that it is about to burst. Through 2007 we led our clients relatively painlessly through the housing bust.

Source: quora.com

Source: quora.com

Through 2007 we led our clients relatively painlessly through the housing bust. This can start in a different financial market such as futures options commodities currencies or bonds. Japan the Tech bubbles and 1929 which sadly I missed were not new types of events. These companies were the ones that soared during the 1990s2000s. In 2001 there was a tech bubble known as the Dot Com Bubble created by excessive speculation in internet-based service companies.

Source: wescapgroup.com

Source: wescapgroup.com

What occurred after was the catalyst for the Tech Bubble - stock volatility. This is the next indicator on the horizon that will underline that we are in a tech bubble and that it is about to burst. Fund raising for tech especially information tech is primarily driven by fundamentals and growth catalysts today as opposed to the euphoria that came to drive venture capitalist in 2000. What occurred after was the catalyst for the Tech Bubble - stock volatility. While much has been written about the similarities or lack thereof between valuations then and now scant attention has been paid to what triggered the bubble.

Source: pinterest.com

Source: pinterest.com

For stocks to move out of this range the market needs a catalyst to send stocks higher or for the 2017 tech bubble to burst. Japan the Tech bubbles and 1929 which sadly I missed were not new types of events. Stock volatility is mainly found in companies that offer little to no dividends. Its hard to argue with the increased user base of technology over the last 15 yearsgrowth has been enormous all around the world. From that heyday in the spring of 2000 prospects for the dot-com industry looked magnificent until the bubble popped.

Source: alambicim.com

Source: alambicim.com

In 2001 there was a tech bubble known as the Dot Com Bubble created by excessive speculation in internet-based service companies. Identifying financial market bubbles is much more difficult than predicting just how inflated they. For stocks to move out of this range the market needs a catalyst to send stocks higher or for the 2017 tech bubble to burst. It was marked by great uprise in the stock prices of particularly Internet based companies from 19972000 and a sudden plunge in the late 2000 -2002. In 2001 there was a tech bubble known as the Dot Com Bubble created by excessive speculation in internet-based service companies.

Source: pinterest.com

Source: pinterest.com

For stocks to move out of this range the market needs a catalyst to send stocks higher or for the 2017 tech bubble to burst. Tech Stocks SP 500 Weightage Mirrors 1999 Bubble. A bubble will only burst IF and WHEN there is a catalyst on the retail-side that triggers a Panic-Mode Run on the stock market. Stock volatility is mainly found in companies that offer little to no dividends. You wont find an agreed-upon singular catalyst for the bursting of 2000s tech bubble.

Source: alambicim.com

Source: alambicim.com

It is created by a surge in the prices which is not based on the fundamentals of an asset but rather the speculative views of the market. During the intoxicating days of quantitative easing QE income-starved investors sent stocks higher no matter what kind of earnings a company reported. What occurred after was the catalyst for the Tech Bubble - stock volatility. In all three we felt we were nearly sure to be right. And there in lies the rub.

Source: pinterest.com

Source: pinterest.com

The peak of the Tech Bubble at least with respect to NASDAQ was on March 10 2020 the SP peaked a little later on March 24th. A combination of factors can come together to produce a rapid unwinding for asset prices. The catalyst for profit taking could be regulatory strains or excessive. During the intoxicating days of quantitative easing QE income-starved investors sent stocks higher no matter what kind of earnings a company reported. This is the next indicator on the horizon that will underline that we are in a tech bubble and that it is about to burst.

The bubble today comes from private investors who are investing in apps and small tech companies. The tech bubble has inflated dramatically and these signs indicate the party could come to a brutal end soon. The aftershock sent NASDAQ tumbling all the way to 3649 before bouncing back slightly to 4223. Its hard to argue with the increased user base of technology over the last 15 yearsgrowth has been enormous all around the world. The number of cases in.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech bubble catalyst by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.