Your Tech bubble define images are ready. Tech bubble define are a topic that is being searched for and liked by netizens now. You can Download the Tech bubble define files here. Get all free vectors.

If you’re searching for tech bubble define pictures information connected with to the tech bubble define topic, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Tech Bubble Define. The first tech bubble between 1995 and 2000 is especially instructive for todays environment where a small group of rapidly growing tech companies has driven the market higher. Tech Bubble is a type of speculative bubble a rapid share price growth of technology stocks. Additional meaning of Tech Bubble. This piece will show how to interpret a large scale system the Tech Bubble and make future predictions based on a plurality of possible assumptions.

Blockchain Bubble Or Revolution The Present And Future Of Blockchain And Cryptocurrencies Blockchain Revolution Bubbles From pinterest.com

Blockchain Bubble Or Revolution The Present And Future Of Blockchain And Cryptocurrencies Blockchain Revolution Bubbles From pinterest.com

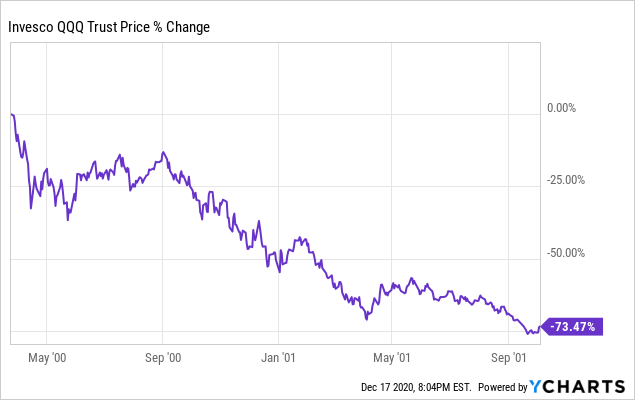

Additional meaning of Tech Bubble. As you can see above from comparing the Nasdaq Composite five-year growth rate between 1995 to 2000 versus 2015 to 2020 theres bubble behavior characterized by modestly exuberant market behavior and then theres BUBBLE behavior where the Nasdaq growth rate during the 90s quadruples that of the past five years. The Tech Bubble. Rapid share price growth and high valuations based on standard metrics. In this way define allows you to have a changing constant that is referred to with the same symbol repeatedly. We define 22800 as the peak of the tech bubble and 22809 as the trough of the financial crisis.

Answers will be based on educated guesses of which as many as are distinguishable and useful are outlined.

Additional meaning of Tech Bubble. I define a bubble as something where assets have prices that cannot be justified with any reasonable assumption says Jay Ritter a professor of finance at the University of. The dotcom bubble formed when investor interest in the untapped potential of Internet companies soared. But we do have all the ingredients for a Tech Bubble. Rapid share price growth and high valuations based on standard metrics. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks.

Source: id.pinterest.com

Source: id.pinterest.com

Narrow buying is an indicator of bubbles where investors focus on just a. Narrow buying is an indicator of bubbles where investors focus on just a. The increased speculation leads to a radical increase in stock prices. Technology stock equity valuations fueled by investments in Internet-based companies in the late 1990s. Answers will be based on educated guesses of which as many as are distinguishable and useful are outlined.

Source: pinterest.com

Source: pinterest.com

Bubble lets you customize your web app to showcase whatever you want and market it however you choose without paying for extra features. The first tech bubble between 1995 and 2000 is especially instructive for todays environment where a small group of rapidly growing tech companies has driven the market higher. Bubble lets you customize your web app to showcase whatever you want and market it however you choose without paying for extra features. As you can see above from comparing the Nasdaq Composite five-year growth rate between 1995 to 2000 versus 2015 to 2020 theres bubble behavior characterized by modestly exuberant market behavior and then theres BUBBLE behavior where the Nasdaq growth rate during the 90s quadruples that of the past five years. Rapid share price growth and high valuations based on standard metrics.

Source: seekingalpha.com

Source: seekingalpha.com

The Tech Bubble. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. Tech Bubble is a type of speculative bubble a rapid share price growth of technology stocks. We define 22800 as the peak of the tech bubble and 22809 as the trough of the financial crisis. The dotcom bubble formed when investor interest in the untapped potential of Internet companies soared.

Source: pinterest.com

Source: pinterest.com

As you can see above from comparing the Nasdaq Composite five-year growth rate between 1995 to 2000 versus 2015 to 2020 theres bubble behavior characterized by modestly exuberant market behavior and then theres BUBBLE behavior where the Nasdaq growth rate during the 90s quadruples that of the past five years. I define a bubble as something where assets have prices that cannot be justified with any reasonable assumption says Jay Ritter a professor of finance at the University of. This piece will show how to interpret a large scale system the Tech Bubble and make future predictions based on a plurality of possible assumptions. Definitions Up Down Capture Batting Average Slugging Ratio Average return of the model portfolio when the benchmark is up down divided by the average return. This time the buying is confined to tech stocks and thats a problem.

Source: pinterest.com

Source: pinterest.com

What is a bubble. I define a bubble as something where assets have prices that cannot be justified with any reasonable assumption says Jay Ritter a professor of finance at the University of. In this post we share our views on why and what to do. The increased speculation leads to a radical increase in stock prices. Such analysis is speculative statistical that is.

Source: medium.com

Source: medium.com

The Tech Bubble. But we do have all the ingredients for a Tech Bubble. People have used Bubble to build marketplaces for boat and dock rentals software subscriptions music lessons gardeners and more. This piece will show how to interpret a large scale system the Tech Bubble and make future predictions based on a plurality of possible assumptions. The dotcom bubble was a rapid rise in US.

Source: pinterest.com

Source: pinterest.com

In this post we share our views on why and what to do. People have used Bubble to build marketplaces for boat and dock rentals software subscriptions music lessons gardeners and more. As you can see above from comparing the Nasdaq Composite five-year growth rate between 1995 to 2000 versus 2015 to 2020 theres bubble behavior characterized by modestly exuberant market behavior and then theres BUBBLE behavior where the Nasdaq growth rate during the 90s quadruples that of the past five years. This time the buying is confined to tech stocks and thats a problem. Narrow buying is an indicator of bubbles where investors focus on just a.

Source: investopedia.com

Source: investopedia.com

Rapid share price growth and high valuations based on standard metrics. In this way define allows you to have a changing constant that is referred to with the same symbol repeatedly. Technology stock equity valuations fueled by investments in Internet-based companies in the late 1990s. The dotcom bubble was a rapid rise in US. Tech Bubble is a type of speculative bubble a rapid share price growth of technology stocks.

Source: pinterest.com

Source: pinterest.com

This piece will show how to interpret a large scale system the Tech Bubble and make future predictions based on a plurality of possible assumptions. When a tech bubble starts many investors think that theres a unique opportunity to earn big capital gains therefore they buy shares at prices that. Such analysis is speculative statistical that is. Asset bubbles came into the mainstream vocabulary after the DotCom Bubble. The term bubble is used so often that it has ceased to have much meaning anymore.

Source: pinterest.com

Source: pinterest.com

We define 22800 as the peak of the tech bubble and 22809 as the trough of the financial crisis. The term bubble is used so often that it has ceased to have much meaning anymore. Tech Bubble is a type of speculative bubble a rapid share price growth of technology stocks. Narrow buying is an indicator of bubbles where investors focus on just a. I define a bubble as something where assets have prices that cannot be justified with any reasonable assumption says Jay Ritter a professor of finance at the University of.

Source: pinterest.com

Source: pinterest.com

But we do have all the ingredients for a Tech Bubble. The increased speculation leads to a radical increase in stock prices. Definitions Up Down Capture Batting Average Slugging Ratio Average return of the model portfolio when the benchmark is up down divided by the average return. Venture capitalists looking for new ways to make money poured millions of dollars into Internet companies whether it looked like they were going to make money or not to. In this way define allows you to have a changing constant that is referred to with the same symbol repeatedly.

Source: pinterest.com

Source: pinterest.com

But we do have all the ingredients for a Tech Bubble. This time the buying is confined to tech stocks and thats a problem. As you can see above from comparing the Nasdaq Composite five-year growth rate between 1995 to 2000 versus 2015 to 2020 theres bubble behavior characterized by modestly exuberant market behavior and then theres BUBBLE behavior where the Nasdaq growth rate during the 90s quadruples that of the past five years. What is a bubble. The dotcom bubble formed when investor interest in the untapped potential of Internet companies soared.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech bubble define by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.