Your Tech bubble predictions images are available in this site. Tech bubble predictions are a topic that is being searched for and liked by netizens now. You can Get the Tech bubble predictions files here. Get all royalty-free vectors.

If you’re looking for tech bubble predictions pictures information linked to the tech bubble predictions interest, you have visit the ideal site. Our website always gives you hints for viewing the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

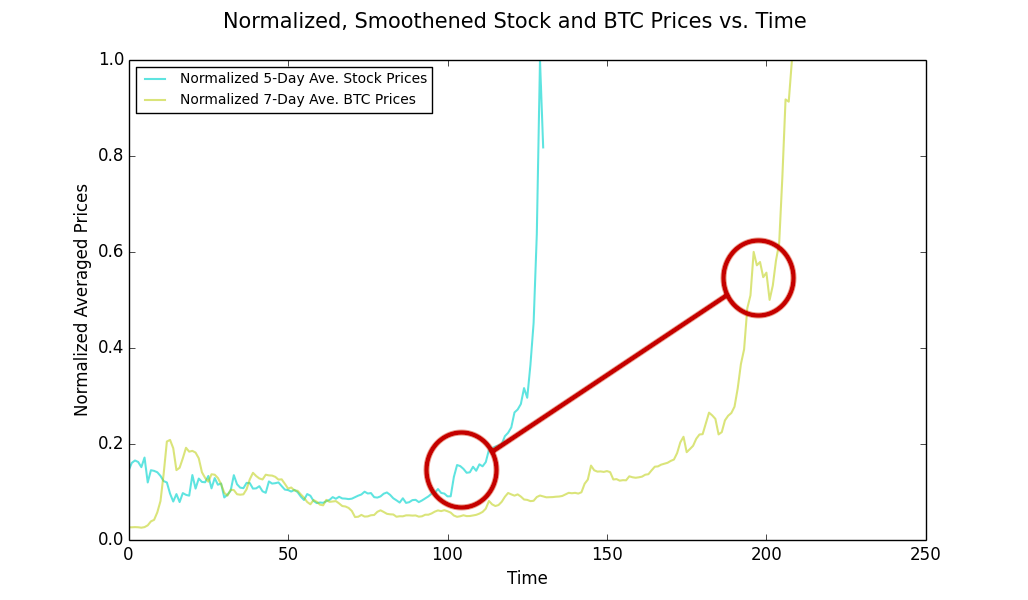

Tech Bubble Predictions. Are we in a tech bubble like 1999. Will it blow up. Big players like Facebook Amazon Apple and Google-parent Alphabet continue to lead the market higher. The Federal Reserve staff continued to predict the US.

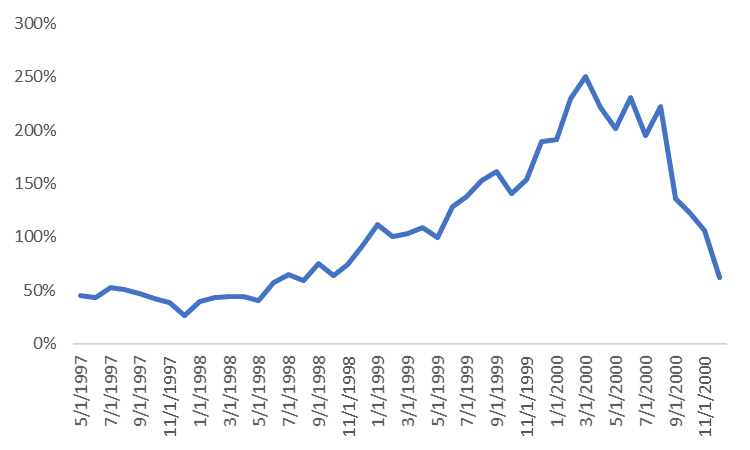

When Will The Dot Com Bubble Burst My 2021 Predictions Fatfire Woman From fatfirewoman.com

Narrow buying is an indicator of bubbles where investors focus on just a few stocks ignoring fundamentals and business conditions. Are we in a tech bubble like 1999. The Federal Reserve staff continued to predict the US. Actually there were no warnings of a tech bubble that we could find in 2009. Big players like Facebook Amazon Apple and Google-parent Alphabet continue to lead the market higher. By Wayne Duggan.

Below are my favorite 15 technology predictions spanning the past 150 years that didnt quite turn out as expected.

Investors should use recent gains to raise cash so they can avoid losses in the next downturn. SP 500 could fall. Today the hottest stocks are Amazon Facebook Netflix Google Microsoft and Apple. Specifically should you invest in Software-as-a-Service SaaS stocks. Can cloud stocks continue to outperform the stock. Will it blow up.

Source: fatfirewoman.com

One of the biggest questions for investors going into 2021 is whether the markets are in another tech bubble similar to the dot-com bubble. Can cloud stocks continue to outperform the stock. Actually there were no warnings of a tech bubble that we could find in 2009. Narrow buying is an indicator of bubbles where investors focus on just a few stocks ignoring fundamentals and business conditions. Specifically should you invest in Software-as-a-Service SaaS stocks.

Source: fatfirewoman.com

Every tech center today votes Democratic from Seattle to San Francisco from Austin to Atlanta. Regards Michael Carr CMT CFTe. Are we in a tech bubble like 1999. One of the biggest questions for investors going into 2021 is whether the markets are in another tech bubble similar to the dot-com bubble. The tech bubble is far from bursting contrary to various predictions.

Source: fatfirewoman.com

Big players like Facebook Amazon Apple and Google-parent Alphabet continue to lead the market higher. Can cloud stocks continue to outperform the stock. Below are my favorite 15 technology predictions spanning the past 150 years that didnt quite turn out as expected. Every tech center today votes Democratic from Seattle to San Francisco from Austin to Atlanta. They see too many private companies valued at 10 billion or morethe so-called unicorns.

Source: quora.com

The technology sector shows no sign of topping out anytime soon. Will it blow up. They see too many private companies valued at 10 billion or morethe so-called unicorns. I rst calculate various metrics of the dot-com companies that went public between 1995 and 1999 and then. December 30 2020 631 pm.

Source: seekingalpha.com

Source: seekingalpha.com

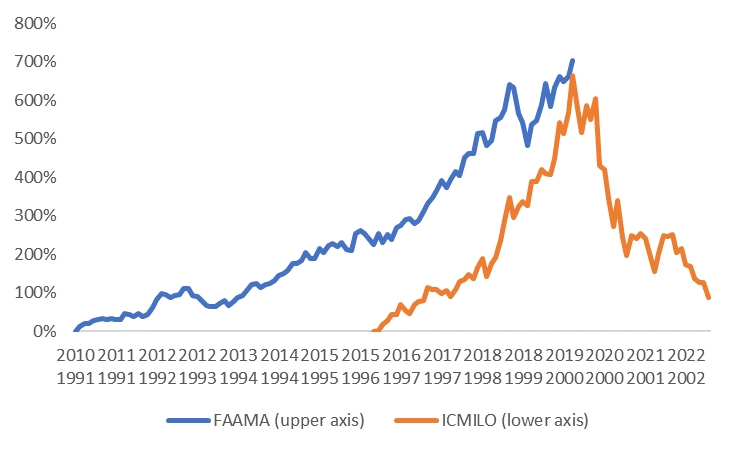

This time the buying is confined to tech stocks and thats a problem. If tech gets the politicians it wants in office the bubble holding todays valuations will burst. They see too many private companies valued at 10 billion or morethe so-called unicorns. Narrow buying is an indicator of bubbles where investors focus on just a few stocks ignoring fundamentals and business conditions. A New Approach to Predicting Speculative Bubbles Vicky Gyor y May 2015 Abstract This paper predicts the likelihood of a growing asset bubble in the technology sector.

Source: fatfirewoman.com

Regards Michael Carr CMT CFTe. AFP PHOTO Damien MEYER. By Wayne Duggan. I rst calculate various metrics of the dot-com companies that went public between 1995 and 1999 and then. The technology sector shows no sign of topping out anytime soon.

Source: seekingalpha.com

Source: seekingalpha.com

Regards Michael Carr CMT CFTe. Are we in a tech bubble like 1999. The Federal Reserve staff continued to predict the US. Can cloud stocks continue to outperform the stock. December 30 2020 631 pm.

Source: alambicim.com

Source: alambicim.com

Today the hottest stocks are Amazon Facebook Netflix Google Microsoft and Apple. JUST WATCHED Scott Minerd. AFP PHOTO Damien MEYER. I rst calculate various metrics of the dot-com companies that went public between 1995 and 1999 and then. The Federal Reserve staff continued to predict the US.

Source: nasdaq.com

Source: nasdaq.com

Economy would grow around 3 percent in 2008 at the height of the Great Recession even as the housing bubble burst and the American economy. Will it blow up. If tech gets the politicians it wants in office the bubble holding todays valuations will burst. The tech rally isnt exactly a pure tech rally but a bubble created by an avoidance of cash itself created by policies attempting to keep the market on life support. One of the biggest questions for investors going into 2021 is whether the markets are in another tech bubble similar to the dot-com bubble.

Source: marker.medium.com

A New Approach to Predicting Speculative Bubbles Vicky Gyor y May 2015 Abstract This paper predicts the likelihood of a growing asset bubble in the technology sector. JUST WATCHED Scott Minerd. One of the biggest questions for investors going into 2021 is whether the markets are in another tech bubble similar to the dot-com bubble. Below are my favorite 15 technology predictions spanning the past 150 years that didnt quite turn out as expected. I rst calculate various metrics of the dot-com companies that went public between 1995 and 1999 and then.

Source: fatfirewoman.com

Regards Michael Carr CMT CFTe. Below are my favorite 15 technology predictions spanning the past 150 years that didnt quite turn out as expected. The Federal Reserve staff continued to predict the US. Are we in a tech bubble like 1999. Specifically should you invest in Software-as-a-Service SaaS stocks.

Source: medium.com

Source: medium.com

December 30 2020 631 pm. Tech industry people have also warned of a tech bubble. One of the biggest questions for investors going into 2021 is whether the markets are in another tech bubble similar to the dot-com bubble. AFP PHOTO Damien MEYER. Regards Michael Carr CMT CFTe.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech bubble predictions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.