Your Tech company valuation methods images are available in this site. Tech company valuation methods are a topic that is being searched for and liked by netizens today. You can Download the Tech company valuation methods files here. Download all royalty-free photos and vectors.

If you’re searching for tech company valuation methods pictures information related to the tech company valuation methods topic, you have visit the right blog. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

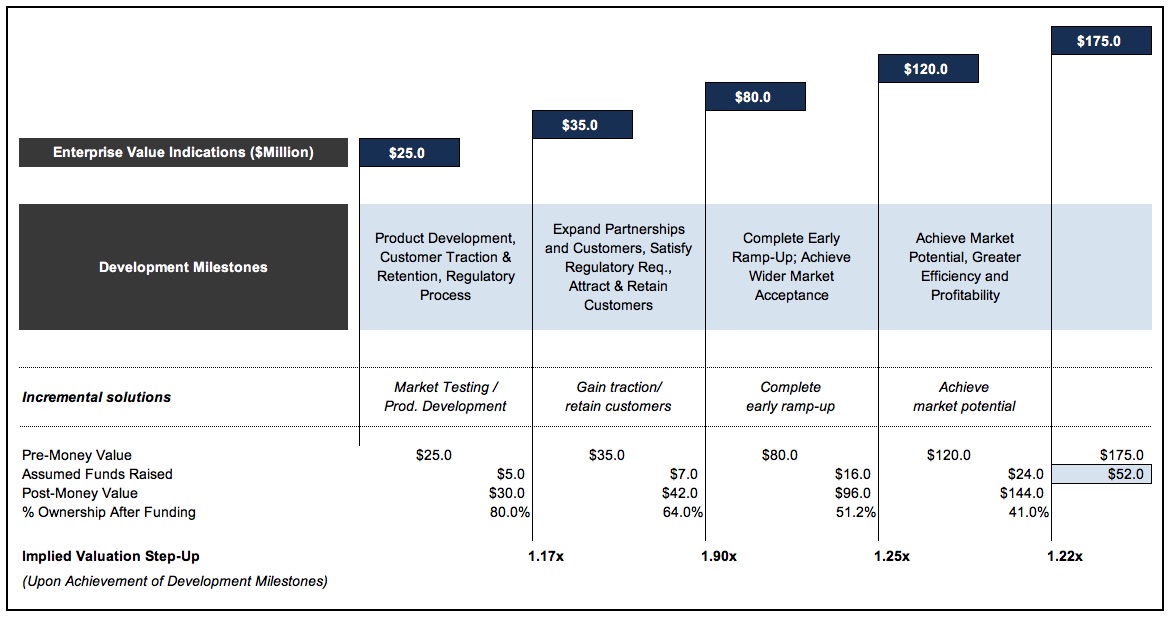

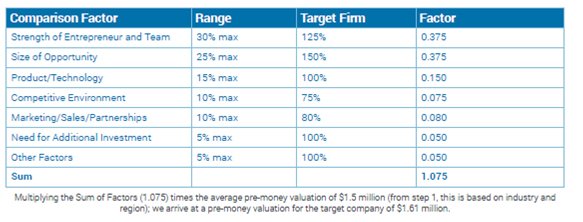

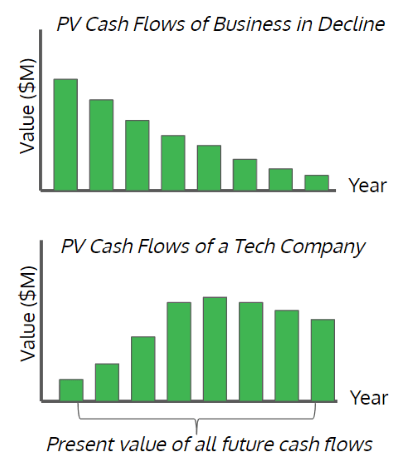

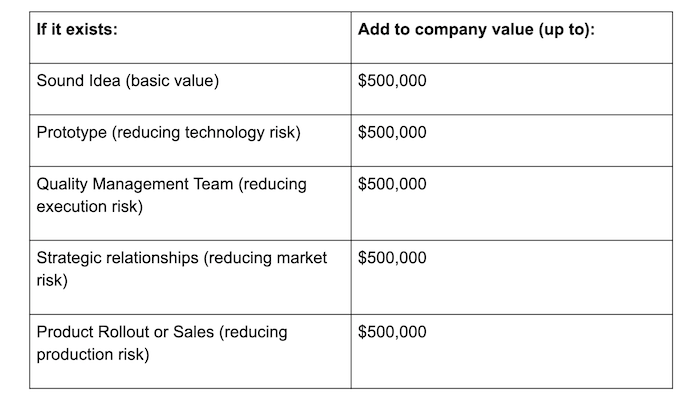

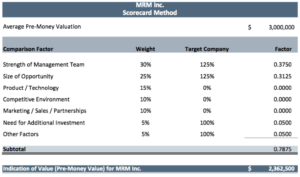

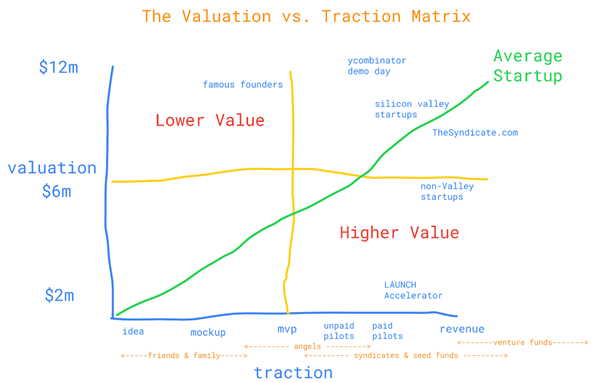

Tech Company Valuation Methods. Valuation By Stage Method. Discounted Cash Flow Method. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. Request your PitchBook free trial to see how our global data will benefit you.

Startup Company Valuation Methods Ppt Powerpoint Presentation Slides Demonstration Cpb Pdf Powerpoint Templates From slidegeeks.com

Startup Company Valuation Methods Ppt Powerpoint Presentation Slides Demonstration Cpb Pdf Powerpoint Templates From slidegeeks.com

Discounted Cash Flow Method. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Has an exciting business idea or business plan. See multiples and ratios. There are many different methods used in deciding on a startups valuation while all of them differ in some way they are all good to use.

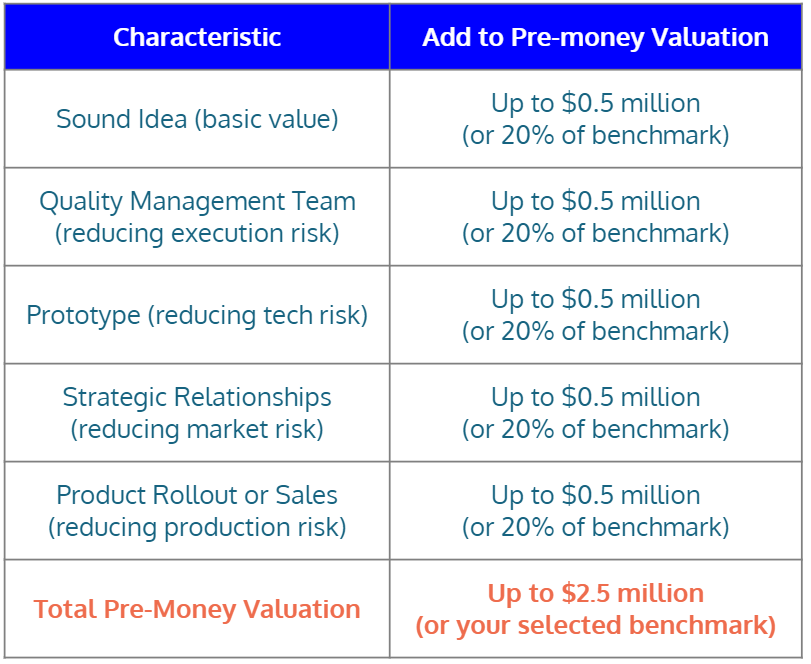

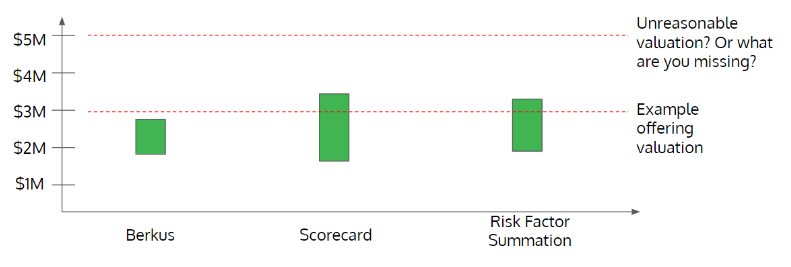

Risk Factor Summation Method.

In profit multiplier the value of the business is calculated by multiplying its profit. PE multiples of future earnings per share EPS is another common method of valuing companies. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. Ad See the value of a company before and after a round of funding. See multiples and ratios. Request your PitchBook free trial to see how our global data will benefit you.

Source: mercercapital.com

Source: mercercapital.com

Ad See the value of a company before and after a round of funding. Price-to-earnings PE ratio comparable. Risk Factor Summation Method. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Request your PitchBook free trial to see how our global data will benefit you.

Source: crowdwise.org

Source: crowdwise.org

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Asset Based Approach a. Price-to-earnings PE ratio comparable. Valuation By Stage Method. There are many different methods used in deciding on a startups valuation while all of them differ in some way they are all good to use.

Source: fullstack.com.au

Source: fullstack.com.au

500000 - 1 million. See multiples and ratios. Going Concern Premise 2. Valuation By Stage Method. Has an exciting business idea or business plan.

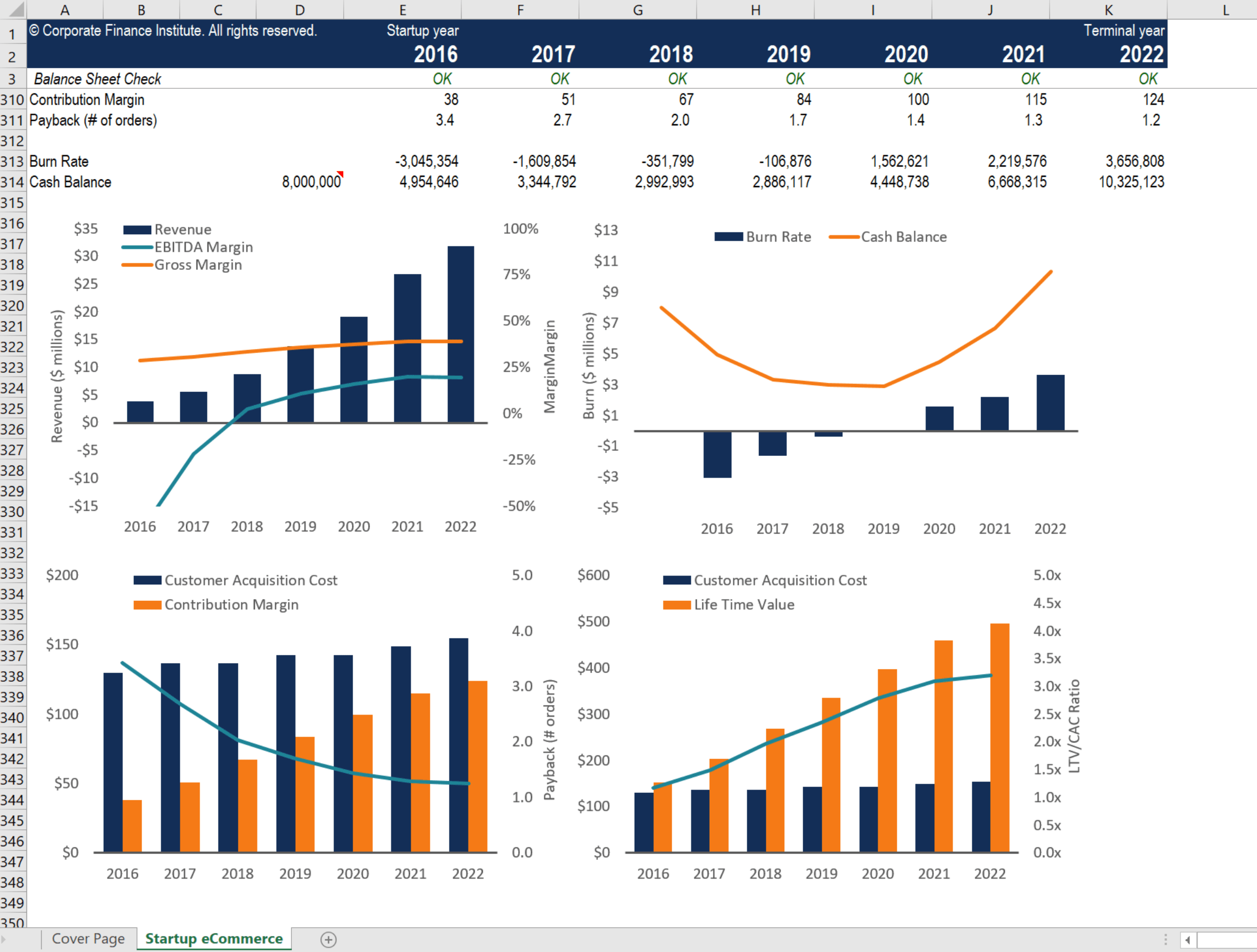

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Ad See the value of a company before and after a round of funding. Going Concern Premise 2. Ad See the value of a company before and after a round of funding. Request your PitchBook free trial to see how our global data will benefit you. Price-to-earnings PE ratio comparable.

Source: slidegeeks.com

Source: slidegeeks.com

1 DCF analysis 2 comparable company analysis and 3 precedent transactions. 500000 - 1 million. See multiples and ratios. The commonly used methods of valuation can be grouped into one of three general approaches as follows. There are many different methods used in deciding on a startups valuation while all of them differ in some way they are all good to use.

Source: crowdwise.org

Source: crowdwise.org

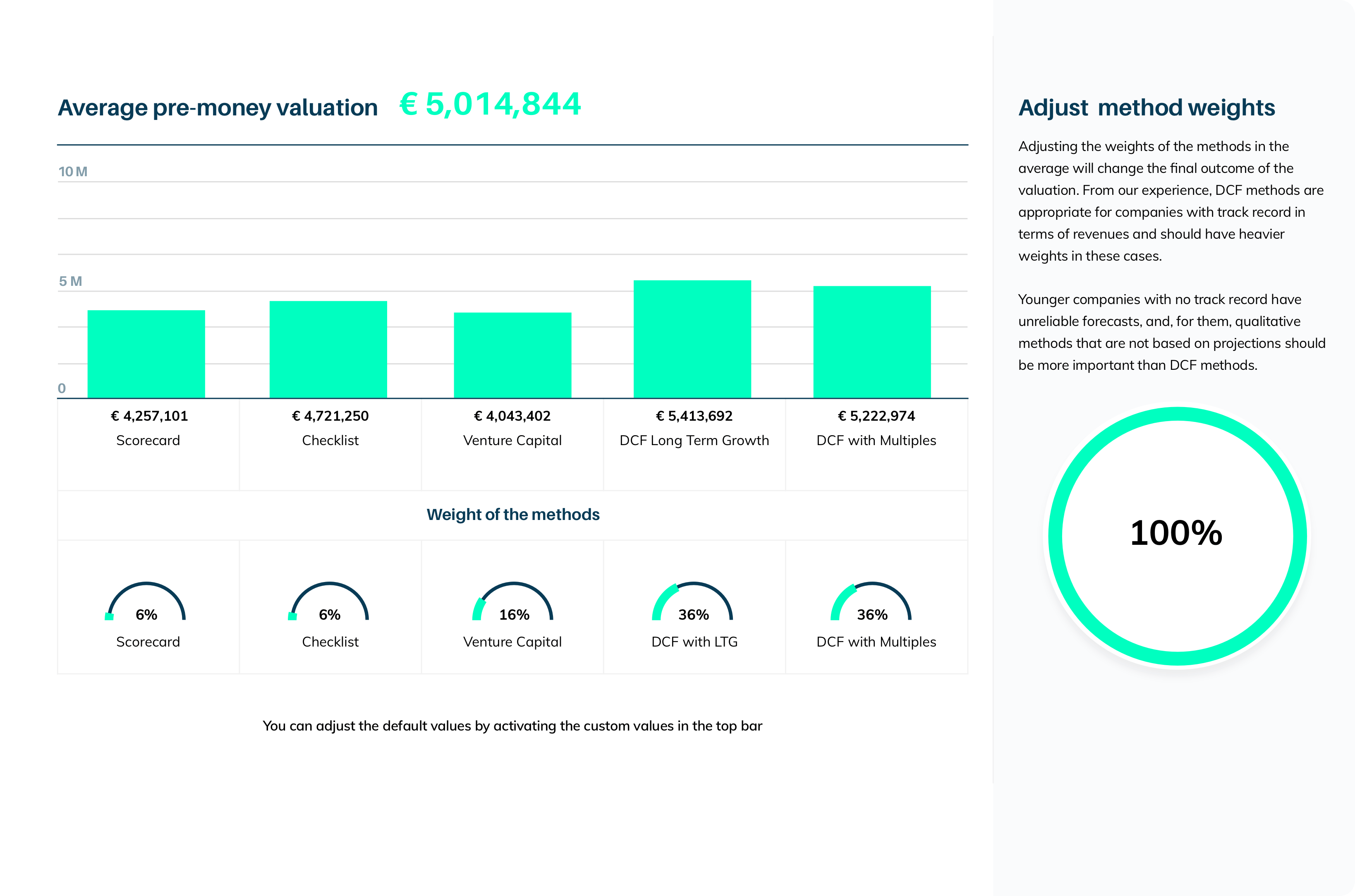

Has a strong management team in place to execute on the plan. Discounted Cash Flow Method. See multiples and ratios. Estimated Company Value. The Most Popular Startup Valuation Methods.

Source: equidam.com

Source: equidam.com

Has a strong management team in place to execute on the plan. Request your PitchBook free trial to see how our global data will benefit you. 500000 - 1 million. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. Risk Factor Summation Method.

Source: crowdwise.org

Source: crowdwise.org

Going Concern Premise 2. Replacement Cost Premise ii. Request your PitchBook free trial to see how our global data will benefit you. Price-to-earnings PE ratio comparable. When valuing a company as a going concern there are three main valuation methods used by industry practitioners.

Source: brex.com

Source: brex.com

Risk Factor Summation Method. 500000 - 1 million. Has an exciting business idea or business plan. Ad See the value of a company before and after a round of funding. Estimated Company Value.

Source: bcgvaluations.com

Source: bcgvaluations.com

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Book Value Method b. PE multiples of future earnings per share EPS is another common method of valuing companies. The commonly used methods of valuation can be grouped into one of three general approaches as follows. 500000 - 1 million.

Source: eloquens.com

Source: eloquens.com

Replacement Cost Premise ii. Request your PitchBook free trial to see how our global data will benefit you. In profit multiplier the value of the business is calculated by multiplying its profit. Request your PitchBook free trial to see how our global data will benefit you. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions.

Source: pro-business-plans.medium.com

Source: pro-business-plans.medium.com

Has an exciting business idea or business plan. Asset Based Approach a. The Most Popular Startup Valuation Methods. Book Value Method b. Has an exciting business idea or business plan.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech company valuation methods by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.