Your Tech debt to equity ratio images are ready. Tech debt to equity ratio are a topic that is being searched for and liked by netizens today. You can Download the Tech debt to equity ratio files here. Get all royalty-free photos.

If you’re looking for tech debt to equity ratio images information linked to the tech debt to equity ratio interest, you have pay a visit to the ideal site. Our website always gives you hints for seeing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

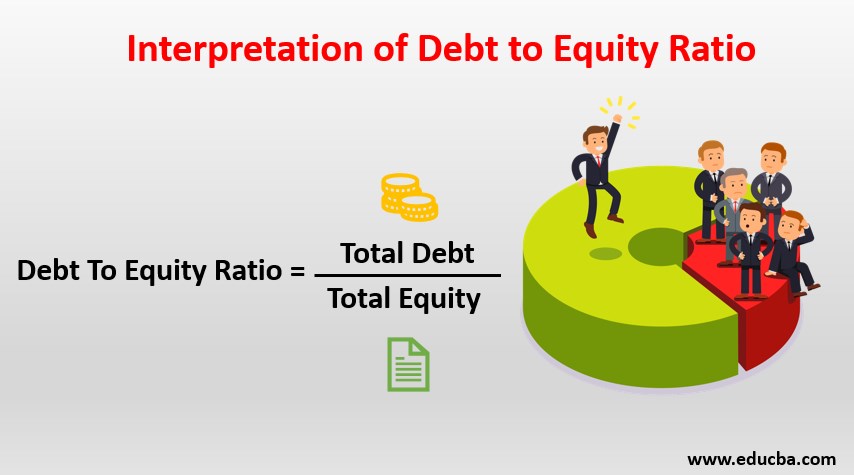

Tech Debt To Equity Ratio. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. In simple words it is the ratio of the total liabilities of a company and its shareholders equity. The debt-to-equity ratio debtequity ratio DE is a financial ratio indicating the relative proportion of entitys equity and debt used to finance an entitys assets. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity.

Infographic Of The Day The Biggest Corporate Debts Visualized In One Chart Debt To Equity Ratio Debt Debt Equity From pinterest.com

Infographic Of The Day The Biggest Corporate Debts Visualized In One Chart Debt To Equity Ratio Debt Debt Equity From pinterest.com

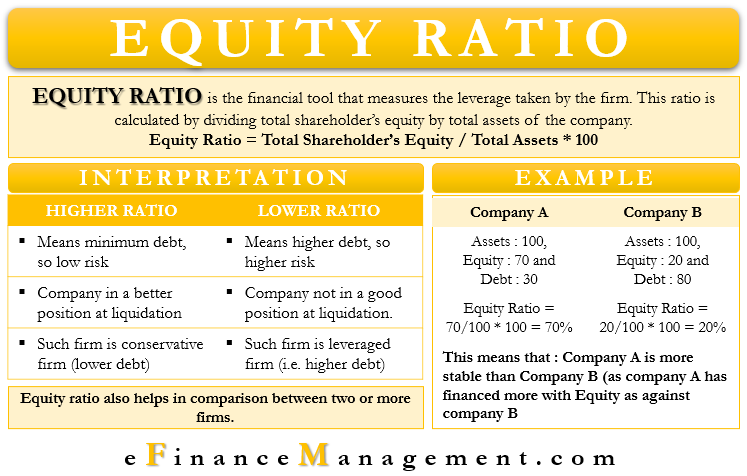

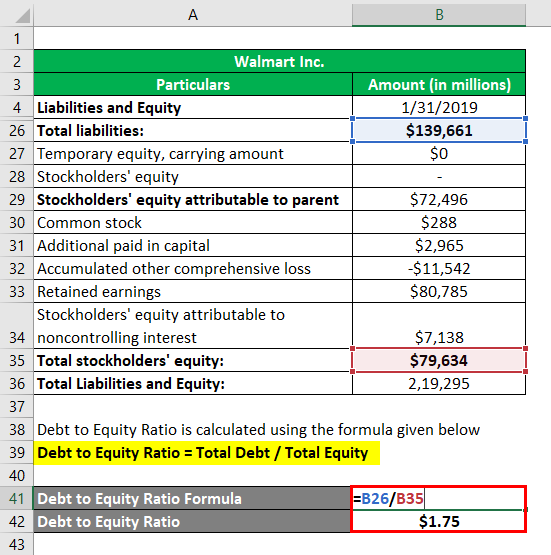

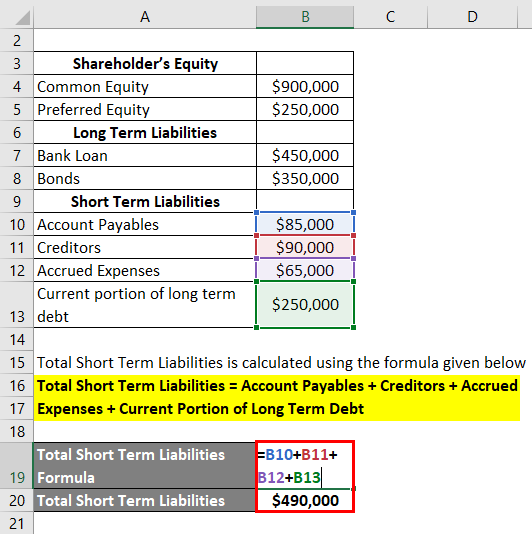

A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt to finance its operating costs. The Debt to Equity ratio also called the debt-equity ratio risk ratio or gearing is a leverage ratio Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet income statement or cash flow statement. 125 rows The debtequity ratio can be defined as a measure of a companys financial leverage. In simple words it is the ratio of the total liabilities of a company and its shareholders equity. Debt to Equity Ratio Definition. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity.

This can result in volatile earnings as a result of the additional interest expense.

The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. It is one of the most. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity. This can result in volatile earnings as a result of the additional interest expense. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average.

Source: educba.com

Source: educba.com

Published by Shanhong Liu Jan 20 2021. Raytheon Technologies debtequity for the three months ending March 31 2021 was 041. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020.

Source: quora.com

This metric is useful when analyzing the health of a companys balance sheet. As of 2020 the debt ratio of the. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity. It is one of the most. 2021 was 011.

Source: wikihow.com

Source: wikihow.com

Raytheon Technologies debtequity for the three months ending March 31 2021 was 041. Ratios higher than 2 are generally unfavorable. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity.

Source: pinterest.com

Source: pinterest.com

The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity. Debt-to-equity ratio is the key financial ratio and is used as a standard for judging a companys financial standing. This can result in volatile earnings as a result of the additional interest expense. This metric is useful when analyzing the health of a companys balance sheet. 75 rows Debt-to-equity ratio - breakdown by industry Debt-to-equity ratio is a financial ratio.

Source: efinancemanagement.com

Source: efinancemanagement.com

A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt. 75 rows Debt-to-equity ratio - breakdown by industry Debt-to-equity ratio is a financial ratio. This can result in volatile earnings as a result of the additional interest expense. The debt-to-equity ratio debtequity ratio DE is a financial ratio indicating the relative proportion of entitys equity and debt used to finance an entitys assets. This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020.

Source: wikihow.com

Source: wikihow.com

Raytheon Technologies Debt to Equity Ratio. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity. Raytheon Technologies debtequity for the three months ending March 31 2021 was 041.

Source: investopedia.com

A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt to finance its operating costs. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. Ratios higher than 2 are generally unfavorable. This metric is useful when analyzing the health of a companys balance sheet.

Source: investopedia.com

Source: investopedia.com

Published by Shanhong Liu Jan 20 2021. Ratios higher than 2 are generally unfavorable. In simple words it is the ratio of the total liabilities of a company and its shareholders equity. Debt to Equity Ratio Definition. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average. This metric is useful when analyzing the health of a companys balance sheet. 125 rows The debtequity ratio can be defined as a measure of a companys financial leverage. A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt. HCL Technologiess debt to equity for the quarter that ended in Mar.

Source: educba.com

Source: educba.com

It is one of the most. 2021 was 011. This can result in volatile earnings as a result of the additional interest expense. A high debt to equity ratio generally means that a company has been aggressive in financing its growth with debt. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity.

Source: wikihow.com

Source: wikihow.com

Debt to Equity Ratio Definition. Current and historical debt to equity ratio values for Tetra Tech TTEK over the last 10 years. Raytheon Technologies Debt to Equity Ratio. This metric is useful when analyzing the health of a companys balance sheet. This can result in volatile earnings as a result of the additional interest expense.

Source: educba.com

Source: educba.com

The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity. Tetra Tech debtequity for the three months ending March 31 2021 was 021. Ratios higher than 2 are generally unfavorable. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech debt to equity ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.