Your When will tech bubble pop images are ready in this website. When will tech bubble pop are a topic that is being searched for and liked by netizens today. You can Find and Download the When will tech bubble pop files here. Download all free images.

If you’re searching for when will tech bubble pop images information related to the when will tech bubble pop topic, you have visit the right site. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

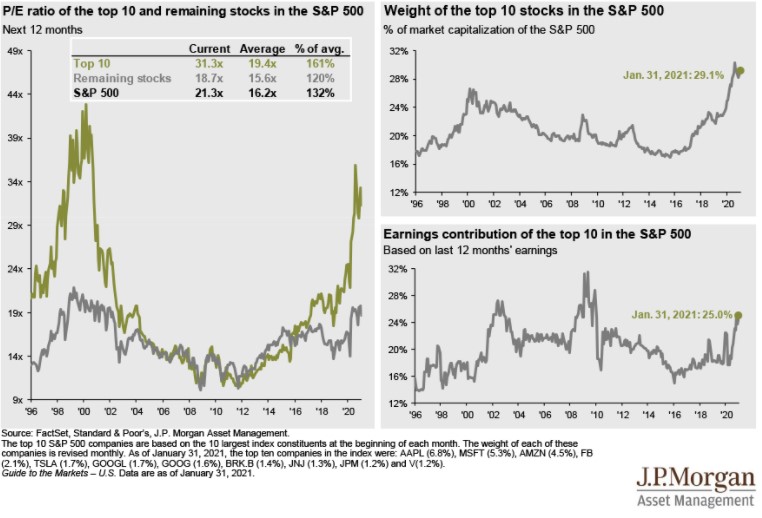

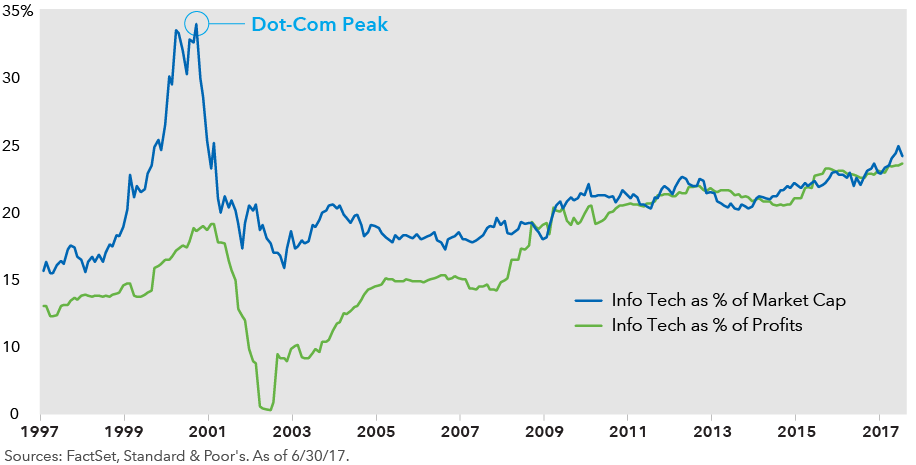

When Will Tech Bubble Pop. Rising inflation and growth outlooks always favour value factors over growth which tends to rise when inflation breakevens fall and investors put aside concerns about immediate return. Elon Musk lost 163bn off his net worth as tech stocks wobbled. It doesnt mean that there is a stock market crash coming as the 2000s tech bubble had a pretty orderly deflation over two years. IXIC fell 82 when the tech bubble popped 20 years ago.

Is The Tech Bubble About To Pop Will History Repeat Itself Like In By Richard Fang The Startup Medium From medium.com

Grantham reminded his readers that the Nasdaq Composite INDEXNASDAQ. The term unicorn in business parlance was created in 2013 by venture capitalist Aileen Lee. On April 6 2000 it was 578. Or are the lofty valuations. By March 30 the NASDAQ was valued at 602 trillion. Signs The Stock Market Bubble Could Be Ready To Pop.

There are risks here that could pop the tech bubble.

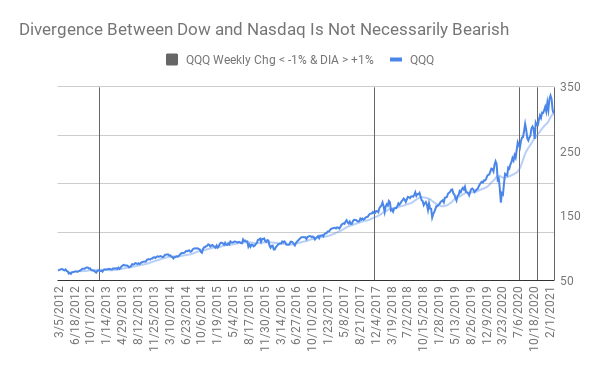

IPO madness aside there are some key differences between the pandemic-era tech rally and the dot-com boom of the late 1990s Is there a bubble in US tech stocksand will it pop. It doesnt mean that there is a stock market crash coming as the 2000s tech bubble had a pretty orderly deflation over two years. So the question isnt if but when this bubble will pop. If as seems likely it happens when interest rates rise and investors chase higher returns how bad will it be. The crash began March 11. Rising inflation and growth outlooks always favour value factors over growth which tends to rise when inflation breakevens fall and investors put aside concerns about immediate return.

Source: warriortrading.com

Source: warriortrading.com

Many cautious investors warned that a tech bubble is in the making after 21 years. Elon Musk lost 163bn off his net worth as tech stocks wobbled. Some say not so bad. Rising inflation and growth outlooks always favour value factors over growth which tends to rise when inflation breakevens fall and investors put aside concerns about immediate return. Signs The Stock Market Bubble Could Be Ready To Pop.

Source: medium.com

Source: medium.com

There are risks here that could pop the tech bubble. Or are the lofty valuations. A tech bubble burst in late 2022 or in 2023 is very possible. The Bitcoin Tech Bubble The rise of Bitcoin from just over 10 in 2013 to 20000 in late 2017 has been one of the largest tech bubbles of all time. As we enter the first of our recovery inflation panics over the next three months of base effects one of the quivering bubbles standing in the way is overvalued growth stocks particularly tech.

Source: awealthofcommonsense.com

Source: awealthofcommonsense.com

So the question isnt if but when this bubble will pop. On March 10 the combined values of stocks on the NASDAQ was at 671 trillion. Some say not so bad. Signs The Stock Market Bubble Could Be Ready To Pop. As we enter the first of our recovery inflation panics over the next three months of base effects one of the quivering bubbles standing in the way is overvalued growth stocks particularly tech.

Source: capitalgroup.com

Source: capitalgroup.com

Some say not so bad. By March 30 the NASDAQ was valued at 602 trillion. The Bitcoin Tech Bubble The rise of Bitcoin from just over 10 in 2013 to 20000 in late 2017 has been one of the largest tech bubbles of all time. If as seems likely it happens when interest rates rise and investors chase higher returns how bad will it be. Many cautious investors warned that a tech bubble is in the making after 21 years.

Source: seekingalpha.com

Source: seekingalpha.com

Some say not so bad. However all the latest corrections have been pretty violent with the latest example being the stock market crash of 2020 where the market dropped 35 in a. We are now officially in a tech bubble larger than March of 2000. As we enter the first of our recovery inflation panics over the next three months of base effects one of the quivering bubbles standing in the way is overvalued growth stocks particularly tech. Even today with tech stock prices still so high he said we may only be at the foothill of bubble phase.

Source: disruptive.asia

Source: disruptive.asia

September 28 2020 1141 The tech sector is a bellwether indicator of when market speculation becomes extreme and when retail piles into the action. IPO madness aside there are some key differences between the pandemic-era tech rally and the dot-com boom of the late 1990s Is there a bubble in US tech stocksand will it pop. IXIC fell 82 when the tech bubble popped 20 years ago. Theres no question that the recent rally in tech stocks rhymes with the lead-up to the tech bubble that burst in 2000 but is the tech sector really in a bubble. So the question isnt if but when this bubble will pop.

Source: disruptive.asia

Source: disruptive.asia

However all the latest corrections have been pretty violent with the latest example being the stock market crash of 2020 where the market dropped 35 in a. Even today with tech stock prices still so high he said we may only be at the foothill of bubble phase. Recently however weve seen the market tumble as profit-takers pulled back from tech stocks on Thursday morning 3rd September 2020 Traveling back. However all the latest corrections have been pretty violent with the latest example being the stock market crash of 2020 where the market dropped 35 in a. It doesnt mean that there is a stock market crash coming as the 2000s tech bubble had a pretty orderly deflation over two years.

Source: sunshineprofits.com

Source: sunshineprofits.com

Many cautious investors warned that a tech bubble is in the making after 21 years. Some say not so bad. Even today with tech stock prices still so high he said we may only be at the foothill of bubble phase. Theres no question that the recent rally in tech stocks rhymes with the lead-up to the tech bubble that burst in 2000 but is the tech sector really in a bubble. September 28 2020 1141 The tech sector is a bellwether indicator of when market speculation becomes extreme and when retail piles into the action.

Source: medium.com

Even today with tech stock prices still so high he said we may only be at the foothill of bubble phase. On March 10 the combined values of stocks on the NASDAQ was at 671 trillion. Many cautious investors warned that a tech bubble is in the making after 21 years. The term unicorn in business parlance was created in 2013 by venture capitalist Aileen Lee. As we enter the first of our recovery inflation panics over the next three months of base effects one of the quivering bubbles standing in the way is overvalued growth stocks particularly tech.

Source: marker.medium.com

So the question isnt if but when this bubble will pop. The term unicorn in business parlance was created in 2013 by venture capitalist Aileen Lee. As we enter the first of our recovery inflation panics over the next three months of base effects one of the quivering bubbles standing in the way is overvalued growth stocks particularly tech. Many cautious investors warned that a tech bubble is in the making after 21 years. By Wayne Duggan.

Source: nasdaq.com

Source: nasdaq.com

The best options available for investors today are value stocks that have vastly under-performed growth stocks and many of. On April 6 2000 it was 578. The term unicorn in business parlance was created in 2013 by venture capitalist Aileen Lee. December 30 2020 631 pm. Theres no question that the recent rally in tech stocks rhymes with the lead-up to the tech bubble that burst in 2000 but is the tech sector really in a bubble.

Source: internethistorypodcast.com

Source: internethistorypodcast.com

Grantham reminded his readers that the Nasdaq Composite INDEXNASDAQ. Many cautious investors warned that a tech bubble is in the making after 21 years. The best options available for investors today are value stocks that have vastly under-performed growth stocks and many of. Or are the lofty valuations. For now the underlying problem is resolved by trading limits placed upon the flash mob by their online brokers.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when will tech bubble pop by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.